Indian Economic Services (IES) is an all India competitive examination conducted by UPSC to recruit group ‘A’ Officers (Includes Indian Statistical Services-ISS) to be placed in the Planning Commission, Planning Board, Ministry of Economic Affairs, and National Sample Survey and other allied offices and departments that need specialists on economics and statistics. Union Public Service Commission (UPSC) is going to conduct the UPSC IES 2020 Exam between 16 to 18 October at various exam centres.

Click here to read Official Notification for UPSC IES Exam 2020

Total: 15 Post

Click here to Download Admit Card for UPSC IES Exam 2020

(I) Nationality

A candidate must be either:—

(a) a citizen of India; or

(b) a subject of Nepal; or

(c) a subject of Bhutan; or

(d) a Tibetan refugee who came over to India, before the 1st January 1962, with the intention of permanently settling in India; or

(e) a person of Indian origin who has migrated from Pakistan, Burma, Sri Lanka, East African countries of Kenya, Uganda, the United Republic of Tanzania, Zambia, Malawi, Zaire and Ethiopia or Vietnam with the intention of permanently settling in India :

Provided that a candidate belonging to categories (b), (c), (d) & (e) above shall be a person in whose favour a certificate of eligibility has been issued by the Government of India.

A candidate in whose case a certificate of eligibility is necessary may be admitted to the examination but the offer of appointment may be given only after the necessary eligibility certificate has been issued to him/her by the Government of India.

(II) Educational Qualification:

The candidates must have obtained a Post Graduate Degree in Economics/Applied Economics/Business Economics/Econometrics from a recognized university or a foreign university approved by the Central Government of India from time to time.

(II)Age limit:

|

Category |

Age relaxation |

|

Scheduled Caste(SC) |

5 years |

|

Scheduled Tribe (ST) |

5 years |

|

A person who has ordinarily been domiciled in the State of Jammu & Kashmir during the period from January 1, 1980, to December 31, 1989 |

5 years |

|

Defence Services Personnel disabled in operations during hostilities with any foreign country or in a disturbed area and released as a consequence thereof |

Up to 3 years |

|

ex-servicemen including Commissioned Officers and ECOs/SSCOs who have rendered at least five years Military Service as on August 1, 2020 |

Up to 5 years |

|

A person with physical disabilities |

Up to 10 years |

Note:

(IV) Physical Standards: Candidates must be physically fit according to physical standard for admission to Indian Economic Service Examination, 2020 as per Regulations given in Appendix III of the rules for the Indian Economic Service Examination, 2020 published in Gazette of India dated 11th August 2020.

The selection process of UPSC IES comprises two stages. The two stages are -

Stage I: Written Exam of 1000 marks

Stage II: Viva-voce or Interview of 200 marks

|

Subject |

Marks |

Time Duration |

|

General English |

100 |

3 hours |

|

General Studies |

100 |

3 hours |

|

General Economics-I |

200 |

3 hours |

|

General Economics-II |

200 |

3 hours |

|

General Economics-III |

200 |

3 hours |

|

Indian Economics |

200 |

3 hours |

Note 1: The papers on General English and General Studies, common to both Indian Economic Service and Indian Statistical Service will be of subjective type.

Note-2: The details of standard and syllabi for the examination are given in Section-II below.

2. The question papers in all subjects will be of Conventional (essay) type.

3. All question paper must be answered in English, question papers will be set in English only.

The candidate will be interviewed by a Board of competent and unbiased observers who will have before them a record of his/her career. The object of the interview is to assess his/her suitability for the service for which he/she has competed. The interview is intended to supplement the written examination for testing the general and specialised knowledge and abilities for the candidate. The candidate will be expected to have taken an intelligent interest not only in his/her subjects of academic study but also in events which are happening around him/her both within and outside his/her own State or Country as well as in modern currents of thought and in new discoveries which should arouse the curiosity of well-educated youth. The technique of the interview is not that of a strict cross-examination, but of a natural, though directed and purposive conversation intended to reveal the candidate's mental qualities and his/her grasp of problems. The Board will pay special attention to assess the intellectual curiosity, critical powers of assimilation, the balance of judgment and alertness of mind, the ability for social cohesion, the integrity of character initiative and capacity for leadership.

The difficulty level of the papers in General English and General Studies will be such as may be expected of a graduate of an Indian University.

The standard of papers in the other subjects will be that of the Master's degree examination of an Indian University in the relevant disciplines. The candidates will be expected to illustrate the theory by facts, and to analyse problems with the help of theory. They will be expected to be particularly conversant with Indian problems in the field of Economics /Statistics.

Candidates will be required to write an essay in English. Other questions will be designed to test their understanding of English and workman-like use of words. Passages will usually be set for summary or precis.

General Knowledge including knowledge of current events and of such matters of everyday observation and experience in their scientific aspects as may be expected of an educated person who has not made a special study of any scientific subject. The paper will also include questions on Indian Polity including the political system and the Constitution of India, History of India and Geography of nature which the candidate should be able to answer without special study.

Part A

1. Theory of Consumer's Demand: Cardinal utility Analysis; Marginal utility and demand, Consumer's surplus, Indifference curve Analysis and utility function, Price income and substitution effects, Slutsky theorem and derivation of the demand curve, Revealed preference theory. Duality and indirect utility function and expenditure function, Choice under risk and uncertainty. Simple games of complete information, Concept of Nash equilibrium.

2. Theory of Production: Factors of production and production function. Forms of Production Functions: Cobb Douglas, CES and Fixed coefficient type, Translog production function. Laws of return, Returns to scale and Return to factors of production. Duality and cost function, Measures of productive efficiency of firms, technical and allocative efficiency. Partial Equilibrium versus General Equilibrium approach. Equilibrium of the firm and industry.

3. Theory of Value: Pricing under different market structures, public sector pricing, marginal cost pricing, peak-load pricing, cross-subsidy free pricing and average cost pricing. Marshallian and Walrasian stability analysis. Pricing with incomplete information and moral hazard problems.

4. Theory of Distribution: Neo classical distribution theories; Marginal productivity theory of the determination of factor prices, Factor shares and adding up problems. Euler's theorem, Pricing of factors under imperfect competition, monopoly and bilateral monopoly. Macro- distribution theories of Ricardo, Marx, Kaldor, Kalecki.

5. Welfare Economics: Inter-personal comparison and aggression problem, Public goods and externalities, Divergence between social and private welfare, compensation principle. Pareto optimality. Social choice and other recent schools, including Coase and Sen.

Part B:

1. Mathematical Methods in Economics: Differentiation and Integration and their application in economics. Optimisation techniques, Sets, Matrices and their application in economics. Linear algebra and Linear programming in economics and Input-output model of Leontief.

2. Statistical and Econometric Methods: Measures of central tendency and dispersions, Correlation and Regression. Time series. Index numbers. A sampling of curves based on various linear and non-linear function. Least square methods and other multivariate analysis (only concepts and interpretation of results). Analysis of Variance, Factor analysis, Principle component analysis, Discriminant analysis. Income distribution: Pareto law of Distribution, lognormal distribution, measurement of income inequality. Lorenz curve and Gini coefficient. Univariate and multivariate regression analysis. Problems and remedies of Heteroscedasticity, Autocorrelation and Multicollinearity.

1. Economic Thought: Mercantilism Physiocrats, Classical, Marxist, Neo-classical, Keynesian and Monetarist schools of thought.

2. Concept of National Income and Social Accounting: Measurement of National Income, Inter relationship between three measures of national income in the presence of Government sector and International transactions. Environmental considerations, Green national income.

3. Theory of employment, Output, Inflation, Money and Finance: The Classical Theory of Employment and Output and Neo classical approaches. Equilibrium, analysis under classical and neoclassical analysis. Keynesian theory of Employment and output. Post-Keynesian developments. The inflationary gap; Demand pull versus cost-push inflation, Philip's curve and its policy implication. The classical theory of Money, the Quantity Theory of Money. Friedman's restatement of the quantity theory, the neutrality of money. The supply and demand for loanable funds and equilibrium in financial markets, Keynes' theory on demand for money. IS-LM Model and AD-AS Model in Keynesian Theory.

4. Financial and Capital Market: Finance and economic development, financial markets, stock market, gift market, banking and insurance. Equity markets, Role of primary and secondary markets and efficiency, Derivatives markets; Future and options.

5. Economic Growth and Development: Concepts of Economic Growth and Development and their measurement: characteristics of less developed countries and obstacles to their development - growth, poverty and income distribution. Theories of growth: Classical Approach: Adam Smith, Marx and Schumpeter- Neo classical approach; Robinson, Solow, Kaldor and Harrod Domar. Theories of Economic Development, Rostow, Rosenstein-Roden, Nurske, Hirschman, Leibenstien and Arthur Lewis, Amin and Frank (Dependency school) respective role of the state and the market. Utilitarian and Welfarist approach to social development and A.K. Sen's critique. Sen's capability approach to economic development. The Human Development Index. Physical quality of Life Index and the Human Poverty Index. Basics of Endogenous Growth Theory.

6. International Economics: Gains from International Trade, Terms of Trade, policy, international trade and economic development- Theories of International Trade; Ricardo, Haberler, Heckscher- Ohlin and Stopler- Samuelson- Theory of Tariffs- Regional Trade Arrangements. ASEAN Crisis of 1998, Global Financial Crisis of 2008 and the Euro Zone Crisis- Causes and Impact.

7. Balance of Payments: Disequilibrium in Balance of Payments, Mechanism of Adjustments, Foreign Trade Multiplier, Exchange Rates, Import and Exchange Controls and Multiple Exchange Rates. IS-LM Model and Mundell- Fleming Model of Balance of Payments.

8. Global Institutions: UN agencies dealing with economic aspects, World Bank, IMF and WTO, Multinational Corporations. G-20.

1. Public Finance: Theories of taxation: Optimal taxes and tax reforms, the incidence of taxation; Theories of public expenditure: objectives and effects of public expenditure, public expenditure policy and social cost-benefit analysis, criteria of public investment decisions, social rate of discount, the shadow price of an investment, unskilled labour and foreign exchange. Budgetary deficits. Theory of public debt management.

2. Environmental Economics: Sustainable development, Rio process 1992 to 2012, Green GDP, UN Methodology of Integrated Environmental and Economic Accounting. Environmental Values: User and Non-Users values; option value. Valuation Methods: Stated and revealed preference methods. Design of Environmental Policy Instruments: Pollution Taxes and Pollution permits, collective action and informal regulation by local communities. Theories of exhaustible and renewable resources. International Environmental agreements, RIO Conventions. Climate change problems. Kyoto Protocol, UNFCC, Bali Action Plan, post-2015 agreements, tradable permits and carbon taxes. Carbon Markets and Market Mechanisms. Climate Change Finance and Green Climate Fund.

3. Industrial Economics: Market structure, conduct and performance of firms, product differentiation and market concentration, monopolistic price theory and oligopolistic interdependence and pricing, entry preventing pricing, micro level investment decisions and the behaviour of firms, research and development and innovation, market structure and profitability, public policy and development of firms.

4. State, Market and Planning: Planning in a developing economy. Planning regulation and market. Indicative Planning. Decentralized Planning.

1. History of Development and Planning: Alternative Development Strategies- the goal of self-reliance based on import substitution and protection, the post-1991 globalisation strategies based on stabilization and structural adjustment packages: fiscal reforms, financial sector reforms and trade reforms.

2 Federal Finance: Constitutional provisions relating to fiscal and financial powers of the states, Finance Commissions and their formulae for sharing taxes, Financial aspect of Sarkaria Commission Report, Financial aspects of 73rd and 74th Constitutional Amendments.

3. Budgeting and Fiscal Policy: Tax, expenditure, budgetary deficits, pension and fiscal reforms, Public debt management and reforms, Fiscal Responsibility and Budget Management (FRBM) Act, Black Money and Parallel economy in India definition, estimates, genesis, con¬sequences and remedies

4. Poverty Unemployment and Human Development: Estimates of inequality and poverty measures for India, appraisal of Government measures, India’s human development record from a global perspective. India’s population policy and development.

5. Agriculture and Rural Development Strategies: Technologies and institutions, land rela¬tions and land reforms, rural credit, modern farm inputs and marketing- price policy and sub¬sidies; commercialization and diversification. Rural development programmes including pover¬ty alleviation programmes, development of economic and social infrastructure and New Rural Employment Guarantee Scheme.

6. India’s experience with Urbanisation and Migration: Different types of migratory flows and their impact on the economies of their origin and destination, the process of growth of urban settlements; urban development strategies.

7. Industry: Strategy of Industrial development: Industrial Policy Reforms; Reservation Policy relating to small scale industries. Competition policy, Sources of industrial finances. Bank, share market, insurance companies, pension funds, non- banking sources and foreign direct investment, the role of foreign capital for direct investment and portfolio investment, Public Sector reform, privatization and disinvestments.

8. Labour: Employment, unemployment and underemployment, industrial relations and labour welfare- strategies for employment generation- The urban labour market and informal sec¬tor employment, Report of National Commission on Labour, Social issues relating to labour e.g. Child Labour, Bonded Labour, International Labour Standard and its impact.

9. Foreign Trade: Salient features of India’s foreign trade, composition, direction and organi¬zation of trade, recent changes in trade policy, the balance of payments, tariff policy, exchange rate, India and WTO requirements. Bilateral Trade Agreements and their implications.

10. Money and Banking: Financial sector reforms, Organisation of India’s money market, changing roles of Reserve Bank of India, commercial banks, development finance institutions, foreign banks and non- banking financial institutions, Indian capital market and SEBI, Development in Global Financial Market and its relationship with Indian Financial Sector. Commodity Market in India- Spot and Futures Market, Role of FMC.

11. Inflation: Definition, trends, estimates, consequences and remedies (control): Wholesale Price Index, Consumer Price Index: components and trends.

The candidates should note that no request for change of centre will be entertained. All the examination centres for the examination will cater to the examination for Persons with Benchmark Disabilities also. Candidates check the list of exam centres given in the table below:

|

Ahmedabad |

Bengaluru |

|

Bhopal |

Chandigarh |

|

Chennai |

Cuttack |

|

Delhi |

Dispur |

|

Hyderabad |

Jaipur |

|

Jammu |

Kolkata |

|

Lucknow |

Mumbai |

|

Patna |

Prayagraj (Allahabad) |

|

Shillong |

Shimla |

|

Thiruvananthapuram |

|

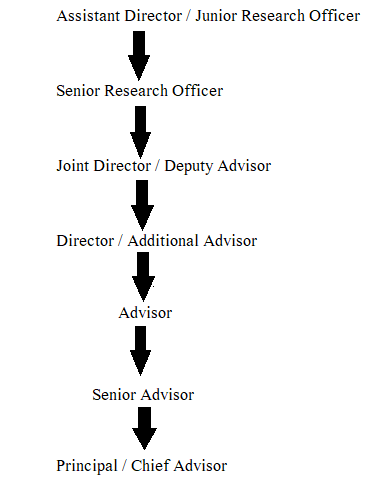

As we all know that the salary differs from the designation and posting. The in-hand salary of an Economic Service officer is INR 59,750 - 56,100 per month. Here is a tabular for detailed salary structure as per the designation of the officers:

|

Grade/ Designation |

Pay Structure |

Strength |

|

Higher Administrative Grade + (HAG +)/ Principal Adviser (Apex) |

INR 80,000 (fixed) |

5 |

|

Higher Administrative Grade (HAG)/ Senior Economic Adviser/ Senior Adviser |

INR 67,000- (annual increment @3%) - 79,000 |

15 |

|

Senior Administrative Grade (SAG)/ Economic Adviser/ Adviser |

INR 37,400-67,000 plus Grade Pay: 10,000 |

89 |

|

Junior Administrative Grade (JAG)/ Joint Director/ Deputy Economic Adviser |

INR 15,600-39,100 plus Grade Pay: 7,600 |

148 |

|

{including Non-Functional Selection Grade (NFSG)/ Director/ Additional Economic Adviser} |

INR 37,400 - 67,000 plus Grade Pay: 8,700} |

148 |

|

Senior Time Scale (STS)/ Deputy Director/ Assistant Economic Adviser/ Senior Research Officer |

INR 15,600 - 39,100 plus Grade Pay: 6,600 |

114 |

|

Junior Time Scale (JTS)/ Assistant Director/ Research Officer |

INR 15,600 - 39,100 plus Grade Pay: 5,400 |

107 |

The Economic Service officers along with a handsome salary will be able to exercise the below-mentioned allowances: